The Federation of Automobile Dealers Associations (FADA) released Vehicle Retail Data for June’24.

FADA President Mr. Manish Raj Singhania provided insights on June 2024’s auto retail performance, stating, “June is traditionally one of the weakest months for India’s auto retail. This year, while the monsoon progressed normally up to Maharashtra, it lost momentum, delaying rains in West Bengal, Bihar, Uttar Pradesh, Chhattisgarh, and Madhya Pradesh. This exacerbated the effects of a severe heatwave in northwest India, contributing to a prolonged hiatus that not only intensified the heatwave but also delayed the sowing operations of kharif (summer sown) crops in northern and north-western regions, thereby impacting rural sales.

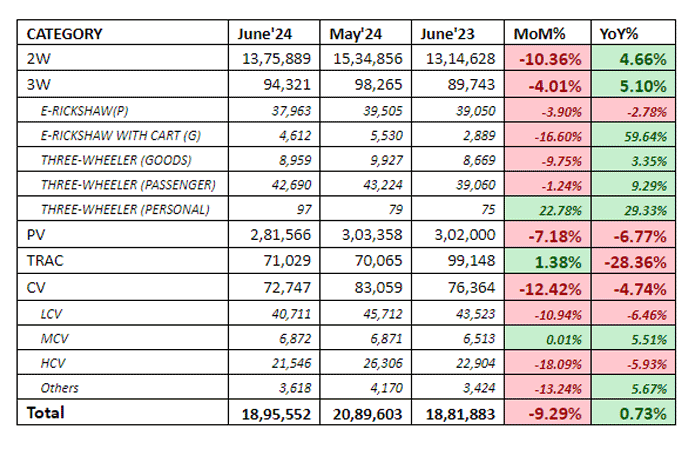

As a result, India’s automobile retail experienced a modest YoY growth of just 0.73%. While the two-wheeler (2W) and three-wheeler (3W) segments registered positive YoY growths of 4.66% and 5.1% respectively, other categories such as passenger vehicles (PV), tractors (Trac) and commercial vehicles (CV) saw declines of 6.7%, 28.3%, and 4.7% YoY, respectively.

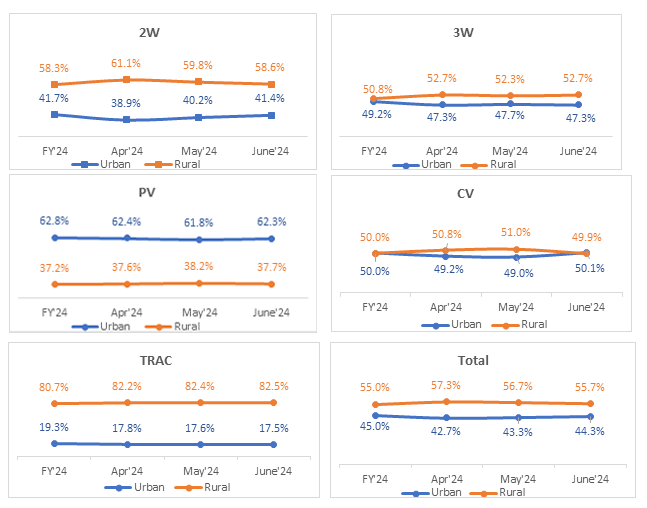

The two-wheeler category faced significant challenges, with a MoM sales decline of 10.36%, despite a 4.66% YoY increase. Factors such as extreme heat which resulted in 13% less walk-in’s, stalled monsoons and election-related market slowdowns particularly affected rural sales, which fell from 59.8% in May to 58.6% in June.

Passenger vehicle sales experienced a notable decline, falling by 6.77% YoY and 7.18% MoM. Inventory levels have reached an all-time high, ranging from 62 to 67 days. Despite improved product availability and substantial discounts aimed at stimulating demand, market sentiment remains subdued due to extreme heat resulting in 15% less walk-in’s and delayed monsoons. Dealer feedback highlights challenges such as low customer inquiries and postponed purchase decisions. With the festive season still some time away, it is crucial for passenger vehicle OEMs to exercise caution. Effective inventory management strategies are essential to mitigate financial strain from high interest costs. FADA strongly urges PV OEMs to implement prudent inventory control and engage proactively with the market.

The commercial vehicle category also experienced a downturn, with sales decreasing by 4.74% YoY and 12.42% MoM. June presented various challenges, including delayed monsoons, poor market sentiment and postponed purchases due to low demand and funding delays. The industry continues to face de-growth, impacted by high temperatures affecting the agricultural sector and infrastructural project slowdowns.”

Chart showing Vehicle Retail Data for June’24 – All India Vehicle Retail Data for June’24

All India Vehicle Retail Strength Index for June’24 on basis of Urban & Rural RTOs.

Disclaimer:

- The above numbers do not have figures from TS & LD.

- Vehicle Retail Data has been collated as on 03.07.24 in collaboration with Ministry of Road Transport & Highways, Government of India and has been gathered from 1,567 out of 1,700 RTOs.

- Commercial Vehicle is subdivided in the following manner

- LCV – Light Commercial Vehicle (incl. Passenger & Goods Vehicle)

- MCV – Medium Commercial Vehicle (incl. Passenger & Goods Vehicle)

- HCV – Heavy Commercial Vehicle (incl. Passenger & Goods Vehicle)

- Others – Construction Equipment Vehicles and others

- 3-Wheeler is sub-divided in the following manner

- E-Rickshaw – Passenger

- E-Rickshaw – Goods

- 3-Wheeler – Goods

- 3-Wheeler – Passenger

- 3-Wheeler – Personal

FADA President Mr. Manish Raj Singhania provided insights on June 2024’s auto retail performance, stating, “June is traditionally one of the weakest months for India’s auto retail. This year, while the monsoon progressed normally up to Maharashtra, it lost momentum, delaying rains in West Bengal, Bihar, Uttar Pradesh, Chhattisgarh, and Madhya Pradesh. This exacerbated the effects of a severe heatwave in northwest India, contributing to a prolonged hiatus that not only intensified the heatwave but also delayed the sowing operations of kharif (summer sown) crops in northern and north-western regions, thereby impacting rural sales.

FADA President Mr. Manish Raj Singhania provided insights on June 2024’s auto retail performance, stating, “June is traditionally one of the weakest months for India’s auto retail. This year, while the monsoon progressed normally up to Maharashtra, it lost momentum, delaying rains in West Bengal, Bihar, Uttar Pradesh, Chhattisgarh, and Madhya Pradesh. This exacerbated the effects of a severe heatwave in northwest India, contributing to a prolonged hiatus that not only intensified the heatwave but also delayed the sowing operations of kharif (summer sown) crops in northern and north-western regions, thereby impacting rural sales.