FADA Vice President Mr. C S Vigneshwar provided insights on July 2024’s auto retail performance, stating, “Following a deficient June, monsoons in India have intensified, resulting in above-normal cumulative rainfall for July. However, the geographical distribution was uneven, with Southern and Central India receiving excess rain, while 10 meteorological divisions experienced a double-digit deficit. Kharif sowing has increased by 2.3% since last year, but these figures are somewhat misleading due to poor sowing activity in the previous year caused by El Nino disruptions. Compared to July 2023, the sown area has actually decreased by 2.4%, according to experts.

FADA Vice President Mr. C S Vigneshwar provided insights on July 2024’s auto retail performance, stating, “Following a deficient June, monsoons in India have intensified, resulting in above-normal cumulative rainfall for July. However, the geographical distribution was uneven, with Southern and Central India receiving excess rain, while 10 meteorological divisions experienced a double-digit deficit. Kharif sowing has increased by 2.3% since last year, but these figures are somewhat misleading due to poor sowing activity in the previous year caused by El Nino disruptions. Compared to July 2023, the sown area has actually decreased by 2.4%, according to experts.

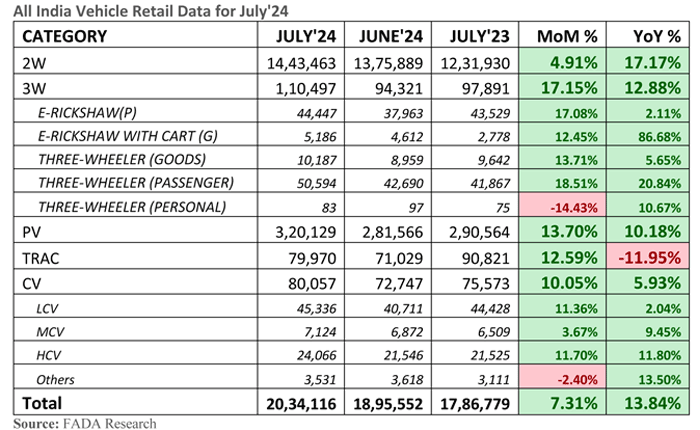

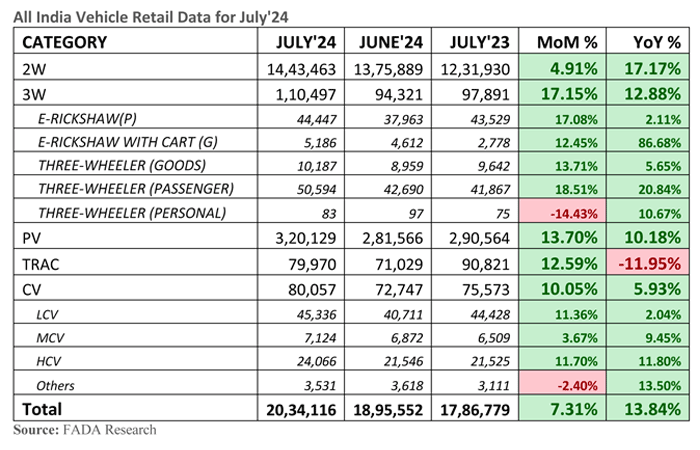

Despite these challenges, India’s automobile retail sector saw a YoY growth of 13.84%, with almost all categories witnessing an increase. Two-wheelers (2W) grew by 17%, three-wheelers (3W) by 13%, passenger vehicles (PV) by 10% and commercial vehicles (CV) by 6%. Tractors, however, continued to underperform, falling by 12% YoY.

The 2W segment experienced notable growth due to a thriving rural economy, positive monsoon effects, and government support programs enhancing rural incomes. The introduction of new products and better stock availability also contributed significantly, despite market slowdowns in certain regions, excessive rains, and increased competition. The segment also saw an increase in EV sales due to discounts and EMPS scheme deadline.

PV sales saw a robust 14% growth, driven by new model launches and attractive pricing strategies. Dealers reported benefits from good product availability, attractive schemes, and a wider range of products. Nonetheless, heavy rains, low consumer sentiment, and intense competition posed challenges. Some dealers managed to sustain sales through strong promotions and incremental discounts.

However, this growth is accompanied by a significant concern. Inventory levels have surged to a historic high of 67-72 days, equating to Rs 73,000 crores worth of stock. This poses a substantial risk for dealer sustainability, necessitating extreme caution. FADA urges PV OEMs to be vigilant about potential dealer failures due to these high inventory levels. It is also crucial for the Reserve Bank of India to mandate financial institutions to implement stringent checks before releasing inventory funding, preferably requiring dealer consent or collaterals to prevent the escalation of NPAs.

CV retail sales showed a 6% YoY growth, with dealers reporting mixed sentiments. Positive factors included growth in the construction and mining sectors, while challenges such as continuous rainfall, negative rural market sentiment, poor finance availability, and high vehicle prices were also noted. Some dealers achieved growth through small bulk deals and leveraging increased market reach and product acceptability.”

Chart showing Vehicle Retail Data for July’24

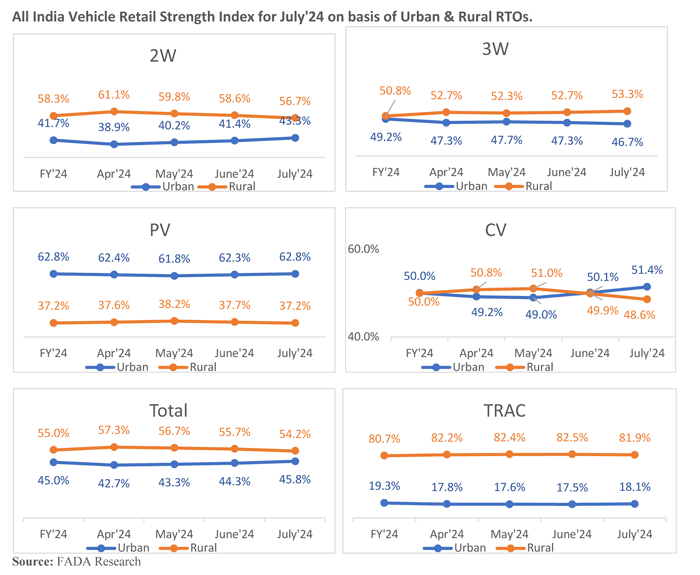

All India Vehicle Retail Strength Index for July’24 on basis of Urban & Rural RTOs.

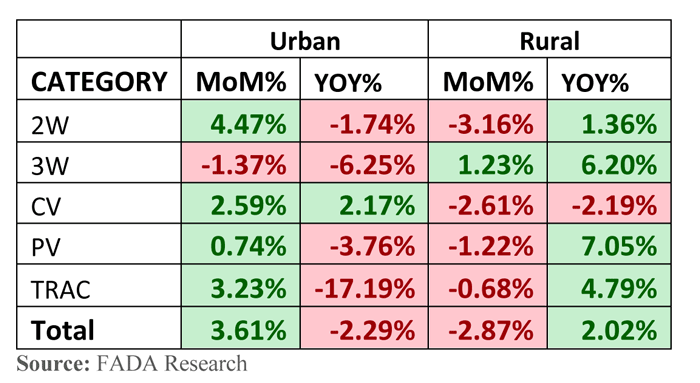

Urban & Rural MOM and YOY analysis