Overview of the Current State of Electric Vehicles (EVs)

The debate surrounding the potential of electric vehicles (EVs) has indeed evolved over the past few years, with significant growth and advancements in the electric vehicle industry. While there has been substantial progress, it is true that several challenges still exist before EVs can become one of the most common powertrains. It’s impressive to see the significant growth of the Electric Vehicle (EV) industry in India across various vehicle segments. The penetration rates in different vehicle segments highlights the increasing acceptance and adoption of electric vehicles in the country.

The Dynamics of the Electric Vehicle Supply Chain in India

India has devised a 3 pillar strategy to promote local manufacturing ecosystem development for EVs – FAME-II, Import Restrictions & Fiscal Incentives or PLI to address the issues of import dependency and to support local manufacturers to develop the capacity to make and scale the EV components. The overall idea is to achieve maximum level of localization of components for which India has or can develop the capability with Government’s support and OEMs investment in EVs. It is imperative to improve the localization level of all critical components and will be the focus in India in future

Largely it is the batteries, motors + invertors DC-DC convertors, and OBCs that encompass the costliest components in EV vehicles covering 70% of the cost of a 30kW battery size EV in the Indian market. Thus, the ecosystem around these components is central to understanding to EV supply chain in India

As of 2023, the Battery pack which remains to be the most critical component is still largely import-driven due to the import of cells and localisation limited to assembly-level operations including welding of bus bars, enclosures, etc. Traction motors coupled with invertors and transmission going by names like e-axles are also largely imported with a knock-down version of the component being imported for the large form factor of vehicles. A more detailed analysis of these components however leads to an understanding that India has reached sufficient volumes and capacity is being lined up for attaining a much higher percentage of localisation in the next 2-3 years.

Unpacking India’s Battery Raw Material Landscape: Opportunities and Challenges

Raw materials are the lifeblood of lithium-ion battery (LiB) localization. Securing a stable and domestic supply of essential elements such as lithium, cobalt, nickel, graphite, and other critical components is paramount to reducing dependence on imports and achieving self-sufficiency in LiB production. Developing a robust supply chain for these raw materials is not only economically strategic but also vital for the long-term sustainability and competitiveness of the electric vehicle industry in a rapidly evolving global landscape.

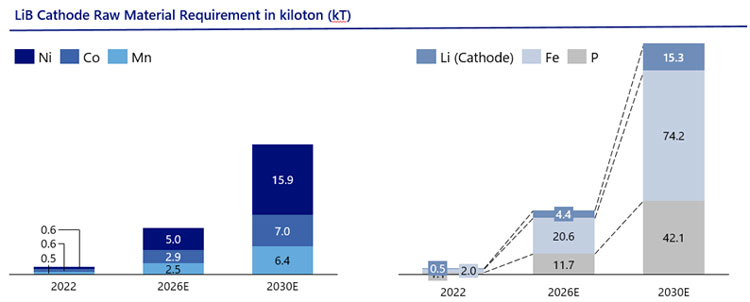

Cathode Materials Scenario

Demand for critical elements is expected to exhibit moderate growth by 2030, with LFP chemistry taking center stage and advanced NMC variants gaining traction. Nickel and cobalt demand is projected to increase, but at a slower pace, due to the shift towards advanced NMC (811) formulations that utilize less nickel. Iron and phosphorus will emerge as pivotal raw materials, with estimated demand of 74 kilotons and 42 kilotons, respectively. These insights underscore India’s strategic trajectory in LiB battery manufacturing, with a focus on optimizing raw material usage, fostering sustainable chemistry choices, and aligning with the nation’s commitment to eco-friendly mobility solutions.

Anode Materials Demand

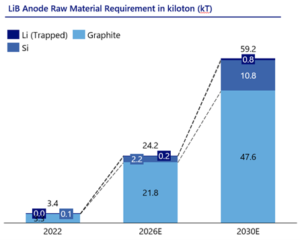

Graphite, the cornerstone of anodes for LiB cells, is expected to witness a steady rise in demand, but silicon-doped graphite is poised to be a game-changer, reducing the demand per kWh of energy produced.

Graphite, the cornerstone of anodes for LiB cells, is expected to witness a steady rise in demand, but silicon-doped graphite is poised to be a game-changer, reducing the demand per kWh of energy produced.

Anodes in LiB cells are primarily graphite-based, but silicon-doped graphite is gaining traction, projected to increase its share from the current 30%. This transition is significant as Si-Gr anodes consume less graphite while offering improved Source: IEA, Niti Aayog, NRI Analysis efficiency.

As new battery technologies like solid-state batteries emerge, they are set to increase the lithium content in anodes. Conversely, sodium-based chemistries will usher in reductions in lithium content.

Cell Components Key Activities in India

There is a critical need to localise the cell supply chain. The cell materials constitute around 40% of its cost, and India has minimal availability of cell raw materials. If India targets to achieve 60% of the value addition (as mandated by the PLI), it needs to localise the manufacturing of anode, cathode, electrolyte, and separator.

Anode Manufacturing Status in India

India’s anode manufacturing is evolving with a focus on meeting global demand while preparing for future domestic needs. Manufacturers are pursuing approvals from global battery makers, driving steady export demand, as local cell manufacturing is expected to take over three years to grow. Competitively priced Indian anodes align with the “China+1” strategy, appealing to manufacturers seeking supply chain diversification. Key players like Epsilon Carbon, HEG, and Himadri are investing heavily to expand production, targeting capacities of 20,000 to 100,000 MT by 2030, highlighting the sector’s growing role in India’s EV and battery industries.

Cathode Manufacturing Status in India

Cathode manufacturing in India is set for growth as demand matures and long-term contracts emerge, but challenges remain. Uncertainty around battery chemistry complicates demand forecasting, and the lack of government incentives and high investment costs hinder entry. Limited technical expertise also drives the need for technology transfer from overseas, while securing raw materials poses another challenge. Despite this, companies like Altmin are making progress, partnering with ARCI to establish a pilot plant in Hyderabad and with the Telangana government to start

Electrolyte Manufacturing Status in India

Electrolyte manufacturing for Lithium-Ion Batteries (LiB) in India is in its early stages, attracting interest from both domestic and global companies. While local salt, a key electrolyte component, is available, competition in the domestic market poses challenges. However, India lacks the production of battery-grade solvents like Ethylene Carbonate (EC), Ethyl Methyl Carbonate (EMC), and Dimethyl Carbonate (DMC), requiring imports. Additives for electrolytes face similar production limitations. Overcoming these challenges and building a strong supply chain will be crucial for the growth of India’s EV and energy storage industries

Separator Manufacturing Status in India

India’s separator manufacturing landscape is gaining traction with investments from global players, but key challenges remain. Long-term contracts with established companies are essential to ensure demand, as the domestic market is still emerging. Securing a reliable local supply chain for raw materials is another priority. Separator manufacturing varies by lithium-ion battery (LiB) application, with wet process separators catering to EVs and dry process separators suited for Energy Storage Systems (ESS). Key players like Neogen, Daramic, and ENTEK are investing heavily, with Neogen planning significant capacity, and Daramic and ENTEK eyeing future expansions. These efforts highlight the growing importance of separator manufacturing in India’s energy storage and EV sectors.

Artice By – Preetesh Singh, Specialist CASE and Alternate Powertrains

Mr. Preetesh Singh works as a Specialist CASE and Alternate Powertrains for Nomura Research Institute Consulting and Solutions India Pvt. Ltd.

Mr. Singh Leads the alternate powertrains and energy practice of Nomura in India

He specializes in CASE and Alternate Powertrains and has spent over a decade on researching various topics related to Automotive Industry for the Indian and global markets. He has been instrumental in setting up the Policy Advocacy, ER&D and Alternate powertrain themes for NRI India

Preetesh is a well-known thought leader in the Automotive industry, having written over 50 reports and articles in collaboration with associations and leading media outlets. He has also spoken at various webinars and conferences about Automotive industry, including Economic times, Assocham, PHD Chamber of Commerce, CVF, REI Expo, The Battery Show India, EV Reporter, Traffic Infra Expo, EMobility+, Battery India, The Smarter India, I-Tech Media, and others.

Preetesh Singh has been actively spreading awareness of alternate fuel and powertrains and their role in future amongst the students by taking guest lectures on the alternate powertrains in different institutes such as NMIMS, Bits Pilani etc.